Business Extension Taxes Due When. If you need more time to file your taxes, you can request an extension through october 15. If you own a business, you have to file tax forms on a regular basis.

3, 2025, to file returns and pay any taxes that were originally due during this period. For the 2023 tax year, filed in 2024, llcs filing as sole proprietors must submit.

Business Extension Taxes Due When Images References :

Source: daraheather.pages.dev

Source: daraheather.pages.dev

Tax Deadline 2024 Extension Form Amelia Corinne, For the 2023 tax year, filed in 2024, llcs filing as sole proprietors must submit.

Source: www.zenledger.io

Source: www.zenledger.io

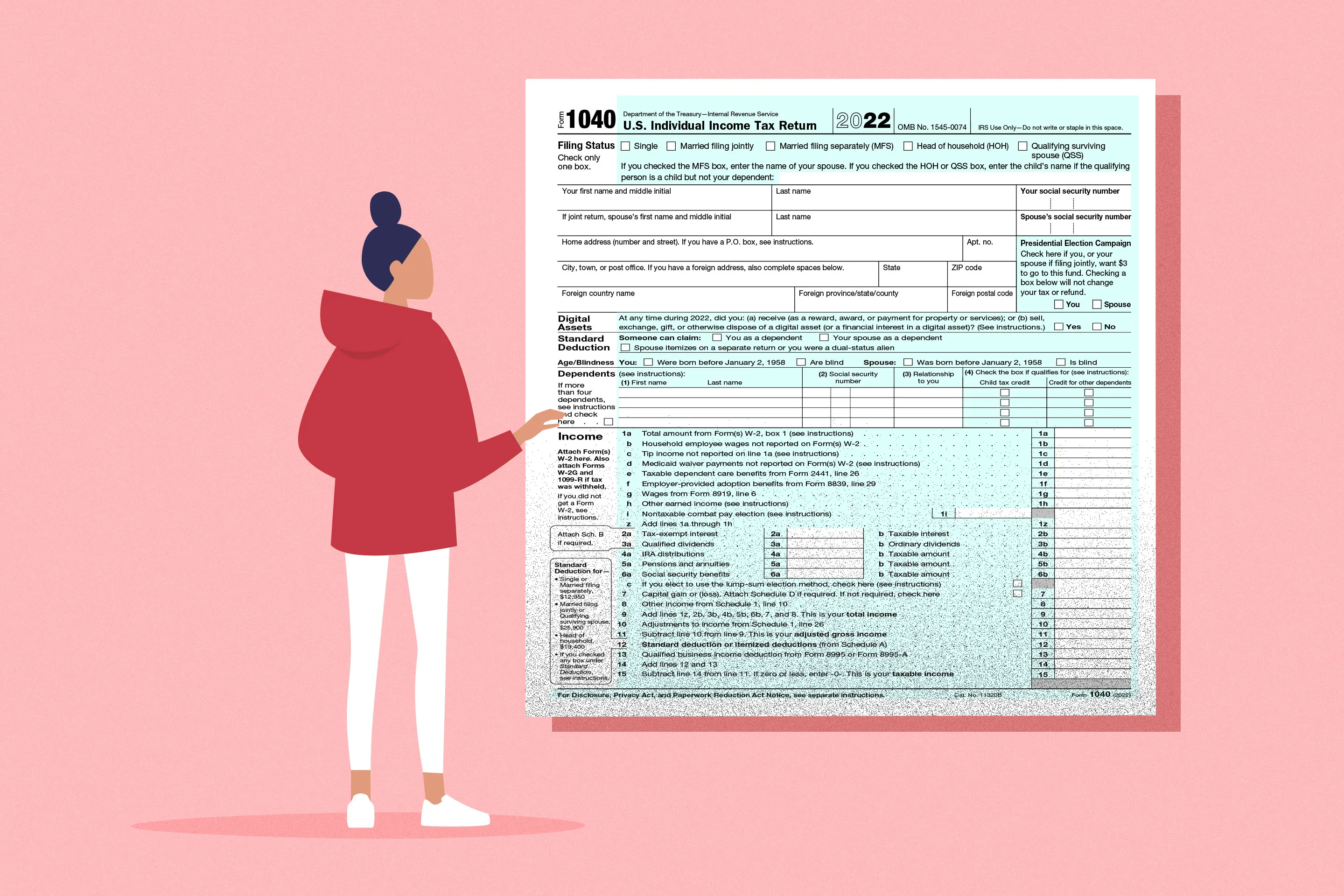

How to File a Tax Extension? ZenLedger, Although you can start filing your taxes as early as january 23rd, the general deadline for filing your 2022 taxes is on april 18, 2023.

Source: gabbeybbeverlie.pages.dev

Source: gabbeybbeverlie.pages.dev

Business Tax Filing Extension Deadline 2024 Poppy Katerina, If your business is a.

Source: arlokasin.weebly.com

Source: arlokasin.weebly.com

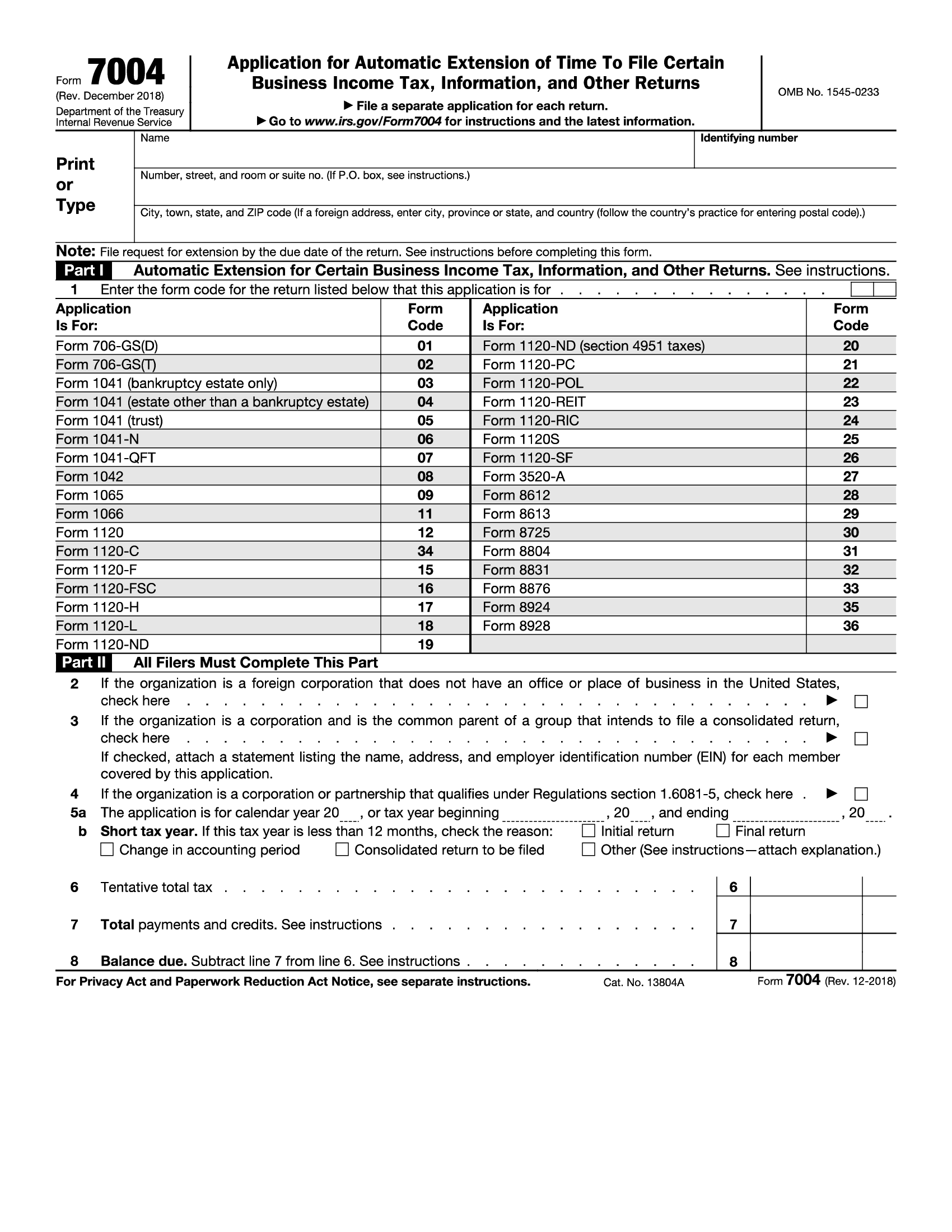

How to file extension for business tax return arlokasin, The extension only applies to filing a return, and doesn't grant an extension for payment of any taxes due.

Source: blog.expressextension.com

Source: blog.expressextension.com

A Quick Overview of State Business Tax Extensions for the State of, The deadline to file form 20s is.

Source: www.taxslayer.com

Source: www.taxslayer.com

Filingataxextensionblogmain The Official Blog of TaxSlayer, The deadline to file form 20s is.

Source: c937jessienorman.blogspot.com

Source: c937jessienorman.blogspot.com

How To File Tax Extension Self Employed, 3, 2025, to file returns and pay any taxes that were originally due during this period.

Source: www.taxuni.com

Source: www.taxuni.com

Filing for Tax Extension 2024 Federal Tax, The extension only applies to filing a return, and doesn't grant an extension for payment of any taxes due.

Source: pilotace.weebly.com

Source: pilotace.weebly.com

Extension for business tax return pilotace, The deadline for a business tax extension form depends on the type of business entity (assuming they all report on a calendar year and not on a fiscal year).

Source: blanker.org

Source: blanker.org

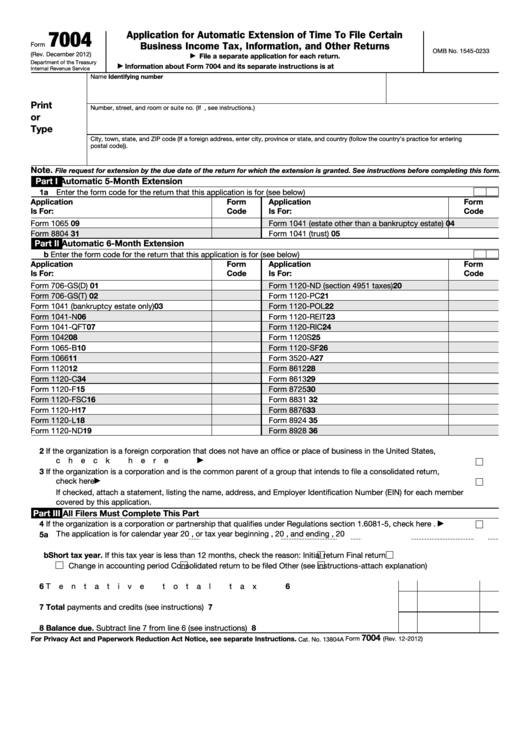

IRS Form 7004. Application for Automatic Extension of Time To File, For the 2023 tax year, filed in 2024, llcs filing as sole proprietors must submit.

Category: 2024