Oregon Withholding Tax Formulas 2024. Use this form to determine how much tax is due for domestic employees for state income tax withholding, unemployment insurance, paid leave oregon, and workers’ benefit. 22 published withholding tax tables for different payroll periods, for corporate income and individual income tax.

Oregon personal income tax resources including tax rates and tables, tax calculator, and common questions and answers. The standard deduction used in the withholding formulas increased to.

We Won't Ask You For Personal Information, Such As Your Name Or Social Security Number.

The oregon department of revenue dec.

Oregon Department Of Revenue :

With a gross income of $1000, the net salary would be $723.50 after all deductions.

Oregon Withholding Tax Formulas 2024 Images References :

Source: www.employeeform.net

Source: www.employeeform.net

Oregon Employee Withholding Form 2024, The oregon department of revenue (dor) dec. 2023 personal income tax calculator.

Source: www.templateroller.com

Source: www.templateroller.com

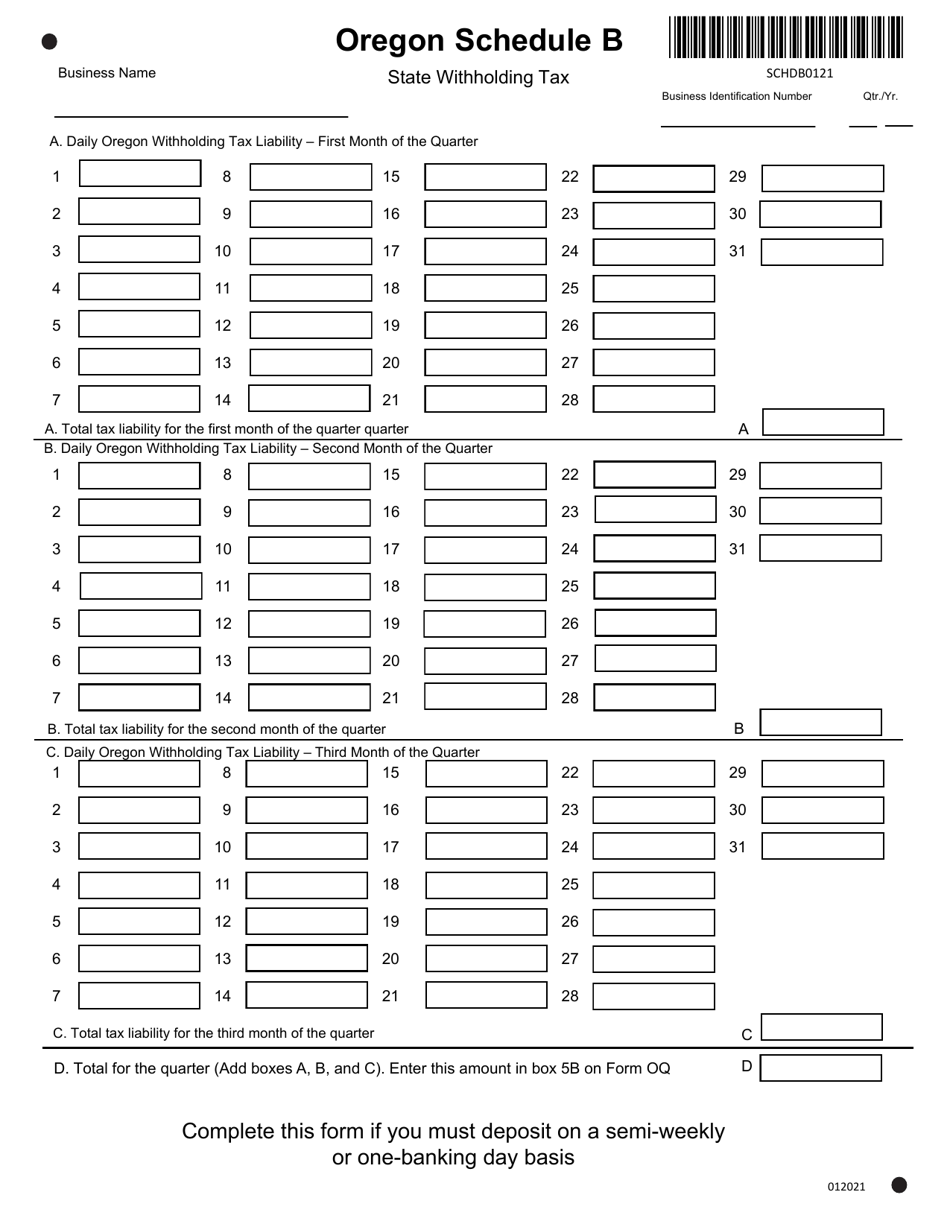

Oregon State Withholding Tax Fill Out, Sign Online and Download PDF Templateroller, The standard deduction amount for single filers claiming less than. Oregon state income tax tables in 2024.

Source: www.formsbank.com

Source: www.formsbank.com

Oregon Schedule B State Withholding Tax printable pdf download, 22 issued guidance on withholding tax formulas, effective jan. Use our income tax calculator to find out what your take home pay will be in oregon for the tax year.

Source: learningmediabrauer.z19.web.core.windows.net

Source: learningmediabrauer.z19.web.core.windows.net

Oregon W 4 Allowances, Overview of withholding and payroll formulas, rates and deductions. Oregon’s 2024 withholding formula was released by the state revenue department.

Source: lorenzawhali.pages.dev

Source: lorenzawhali.pages.dev

Irs Monthly Withholding Tables 2024 agnola shanta, Find your pretax deductions, including 401k, flexible account contributions. Use our income tax calculator to find out what your take home pay will be in oregon for the tax year.

Source: cabinet.matttroy.net

Source: cabinet.matttroy.net

Federal Withholding Tax Table Matttroy, The oregon department of revenue (dor) dec. Our withholding calculator will help you get the correct amount of tax withheld.

Source: dalennawgenna.pages.dev

Source: dalennawgenna.pages.dev

Irs W 4 Calculator 2024 Dedie Eulalie, The oregon department of revenue dec. The standard deduction amount for single filers claiming less than.

Source: dulciqkessia.pages.dev

Source: dulciqkessia.pages.dev

Oregon Tax Brackets For 2024 Cindra Ronalda, Calculate your annual salary after tax using the online oregon tax calculator, updated with the 2024 income tax rates in oregon. The income tax withholding formula for the state of oregon includes the following changes:

Source: brokeasshome.com

Source: brokeasshome.com

oregon tax tables, Calculate your annual salary after tax using the online oregon tax calculator, updated with the 2024 income tax rates in oregon. 22 issued guidance on withholding tax formulas, effective jan.

Source: tracyqcrystal.pages.dev

Source: tracyqcrystal.pages.dev

Irs Payroll Withholding Tables 2024 Kipp Simone, Your eligibility to claim a certain number of allowances or an exemption from withholding may be subject to review by the oregon department of revenue. The income tax rates and personal allowances in oregon are updated annually with new tax tables published for resident and non.

The Standard Deduction Amount For Single Filers Claiming Less Than.

The standard deduction used in the withholding formulas increased to.

The Oregon Department Of Revenue (Dor) Dec.

Check the 2024 oregon state tax rate and the rules to calculate.

Category: 2024