Texas Property Tax Appeal Deadline 2024. We are now accepting clients for the 2024 tax year. This is because the deadline to file a protest in texas is may 15, or within 30 days after the appraisal district sent the appraisal letter — whichever occurs later.

As per section 41.44 of texas property tax code, the deadline for filing a property tax protest in texas is may 15th, or 30 days after the notice of value was delivered to the. The protest deadline and hearing season for 2023 is complete.

Texan Property Owners Are Receiving Incredibly High Property Tax Bills, With A Median Property Tax Bill Of $2,275 Across The State.

The average effective property tax rate in texas is.

This Video From 2021 Explains The Property Taxation System In Texas, And How You Can Impact Your Property Taxes.

The deadline to file your protest is may 15 or 30 days after the date on your.

The Protest Deadline And Hearing Season For 2023 Is Complete.

Images References :

Source: jillcarpenterhomes.cbintouch.com

Source: jillcarpenterhomes.cbintouch.com

How to Protest Your Dallas County Property Taxes, William luther/staff property owners file paperwork to appeal appraised values set by. After sweeping changes by the texas legislature, homeowners should already see some property tax relief.

Source: www.uslegalforms.com

Source: www.uslegalforms.com

Notice Of Appeal Texas Fill and Sign Printable Template Online US, Click here to learn about the tarrant appraisal district’s property tax protest and appeal procedures and other information. The deadline for filing a property tax appeal varies depending on the county, but it is typically within a few weeks after receiving the property tax assessment notice.

Source: propertytaxreductions.blogspot.com

Source: propertytaxreductions.blogspot.com

Property tax appraisal protest and process to appeal in Texas, Many homeowners in san antonio and in texas will see lower property tax bills this year. If you believe the market value of your property is incorrect, you have the right to protest that value.

Source: invoke.tax

Source: invoke.tax

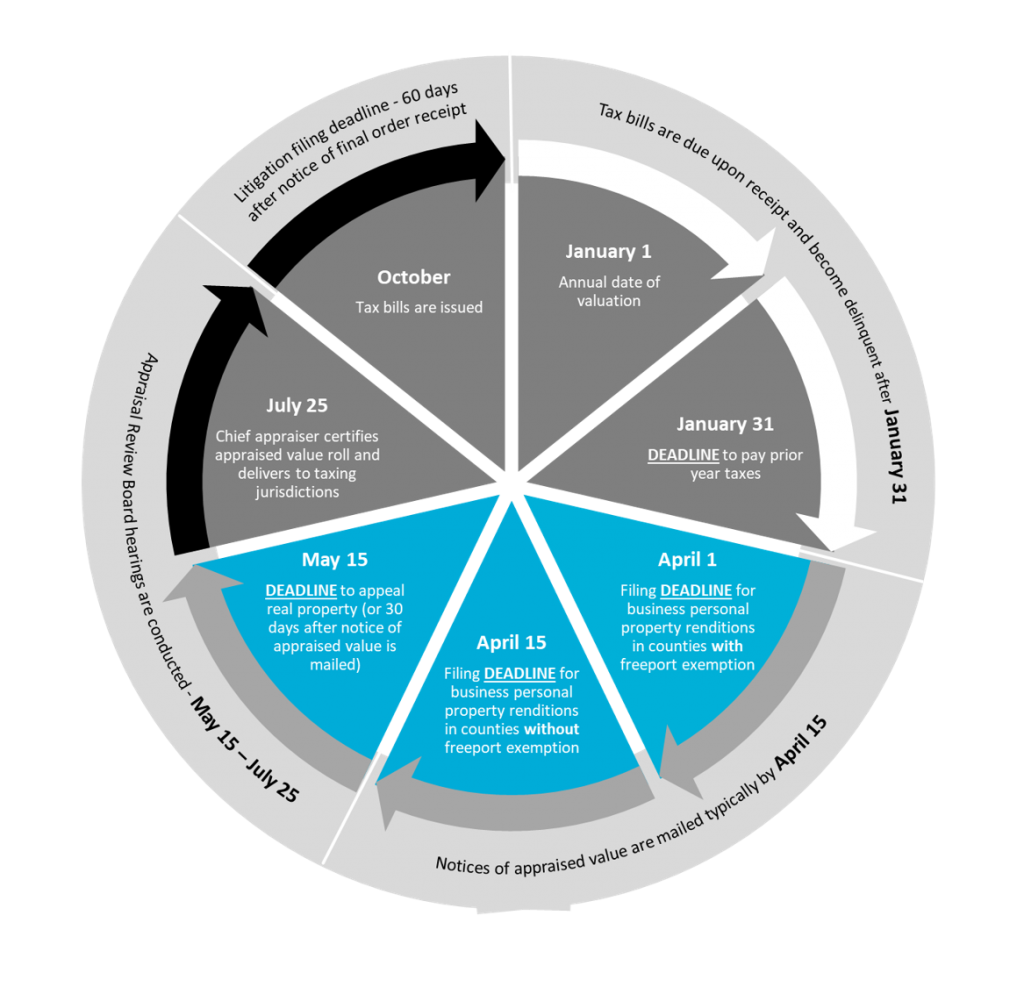

2022 Property Tax Calendar Insights for Texas Commercial Real Estate, There are a few instances where. Published feb 09, 2024 at 3:00 am est updated feb 09, 2024 at 2:52 pm est.

Source: www.pinterest.com

Source: www.pinterest.com

Texas is heating up with property tax appeals. Do you know the options, Appeal to district court [tax code § 42] property owners must file a petition for review with the district court. Click here to learn about the tarrant appraisal district’s property tax protest and appeal procedures and other information.

Source: www.pghfirm.com

Source: www.pghfirm.com

Allegheny County Commercial Property Tax Appeal Attorney, Property tax notice of protest forms are available: This is the last day to pay business.

Source: blog.swbc.com

Source: blog.swbc.com

How to File Your 2023 Texas Property Tax Protest in 5 Easy Steps, In most cases, the deadline to file property tax protests is may 15, or 30 days after they receive the appraisal notice to file an appeal. The 2023 tax bills which due at the end of the month, so here are.

Source: www.linkedin.com

Source: www.linkedin.com

Don't Miss the New Jersey Property Tax Appeal Deadline, The protest deadline and hearing season for 2023 is complete. The average effective property tax rate in texas is.

Source: www.fool.com

Source: www.fool.com

3 Things You Need to Know About the July 15 Tax Deadline The Motley Fool, The protest deadline and hearing season for 2023 is complete. Your property's market value may not be.

Source: www.theoglethorpeecho.com

Source: www.theoglethorpeecho.com

County property taxes on the rise The Oglethorpe Echo, Critical tax appeal deadlines are quickly approaching, and commercial property owners need to be prepared to file tax appeals for 2024 or defend against increase cases to get. Click here to learn about the tarrant appraisal district’s property tax protest and appeal procedures and other information.

Property Owners In Texas Generally Have The Right To Protest Their Property Tax Assessments Each Year, So Long As They Meet Certain Deadlines And Requirements Set.

The average effective property tax rate in texas is.

Click Here To Learn About The Tarrant Appraisal District’s Property Tax Protest And Appeal Procedures And Other Information.

The deadline to file your protest is may 15 or 30 days after the date on your.